Scam Alert: We are aware of email scams which claim to come from PayID. PayIDs are managed by your bank, and PayID will never contact you directly. If you have concerns, please contact your bank.

Fast, Secure Payments

Use your mobile number, email address, ABN or Organisation Identifier as your PayID® to receive fast payments.

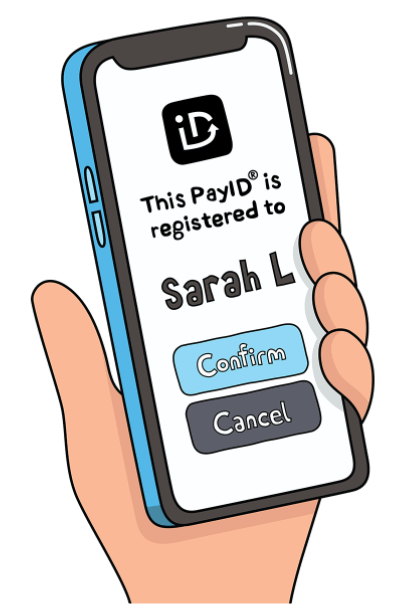

The best part about paying to a PayID is that you’ll know your money is going to the right person or business before you hit send.

Why use a PayID?

fast

Payments will be sent fast, even between different banks.

Some payments may be subject to security checks which could delay a payment. Speak to your bank for more information.

simple

Your PayID is a memorable piece of information that’s unique to you, so it’s easier to remember!

Payments can be made with online banking in a few easy steps.

secure

accurate

flexible

You can move your PayID between different accounts and banks.

You can also create multiple PayIDs if you have more than one account.

Stay safe and be scam aware

If something seems or smells off, you might be right.

PayID will never contact you directly. Not ever.

Emails or text messages claiming to be from PayID are a scam.

PayID will never ask you to send money to receive money or ask you to ‘upgrade’ your account.

PayID is already in your online banking

PayID is offered by over 100 banks, credit unions, building societies and other organisations. Payments to a PayID can be made within the security of your online banking.

Our most frequently asked questions

Details of your registered PayID are available in your online banking. If you can’t find these details, any of your banks that offer PayID can raise an investigation on your behalf to locate which account your PayID is linked to.

You may have created your PayID when it first launched and forgotten which bank you registered it with. Check with each of the banks you have an account with and if you still can’t find it, any of your banks that offer PayID can raise an investigation on your behalf.

Payments to your PayID should arrive in under a minute if they have been sent to the correct PayID. Some payments may be subject to security checks which could delay a payment. Contact your bank for more information.

Payments to a PayID should arrive in under a minute if they have been sent to the correct PayID. If the person or business you have tried to pay have not received your payment, you should contact your bank for help.

Regardless of what payment method you use, always be alert to scams. Scams using PayID as a payment method can be reported to your bank and to the police. For more information and support about how you can protect yourself against fraud, visit Scamwatch here.

Most Australian banks, building societies and credit unions offer PayID. Search for your bank above.

We are aware of emails requesting customers to update their PayID. PayIDs are managed by your bank, and PayID would never contact you directly. If you have concerns, contact your bank.